Best Features of Unum Life Insurance

Dec 07, 2023 By Susan Kelly

Because they do not sell life insurance policies to individuals, the only way to get one is to obtain employment with a company that provides such plans for its employees. The business has a high financial strength rating, which indicates that it is likely to be able to satisfy future insurance claims. Additionally, the business has had fewer complaints than would be anticipated for a firm of its size.

Pros

- AM Best has given Unum an A grade, which indicates that the company has "Excellent" financial strength. Solid financial ratings

- Consumers have access to educational resources on the website, which may assist them in determining the sort of coverage they need and the appropriate amount of coverage.

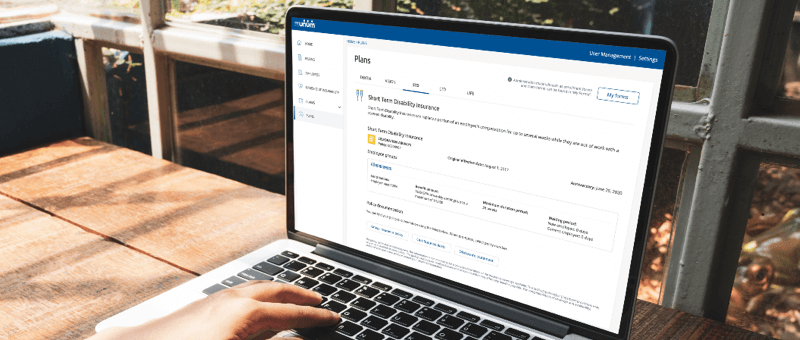

- Online claim filing allows policyholders to avoid having to download forms and send them in via mail by instead allowing them to submit claims and upload supporting documentation online.

- Unum got a far lower number of customer complaints than anticipated, suggesting that the company's total customer satisfaction levels are rather high.

Cons

- There are only term and whole life insurance products available via Unum.

- On the Unum website, there is no function for users to use if they are looking for immediate responses to their inquiries.

Complaint Index

Each year, the National Association of Insurance Commissioners (NAIC) computes a complaint index for each insurance provider, which measures the number of customer complaints the provider received compared to the provider's market share.

If an insurance provider has a complaint index of 1.00, it indicates that the firm has received the average number of complaints for its size. If the index is less than 1, the company got fewer complaints than anticipated. If its index is higher than 1.00, it got a bigger number of complaints than was anticipated. The three-year average complaint index for Unum is 0.27, which indicates that during that period, the firm received a much lower number of complaints than one could have anticipated for a business of its size.

Ratings from a Third Party

AM Best is a credit rating service that evaluates the monetary stability of insurance firms using a letter scale that ranges from A++ to D, with A++ being the highest rating and D representing the lowest rating. Unum was given the rating of A (Outstanding), which indicates that AM Best considers the firm to be in an excellent position to satisfy its continuing insurance obligations, including the payment of claims.

Policies Available

Term life and whole life are the two types of life insurance plans that Unum provides.

Term Life

Your beneficiaries will receive a death benefit from your term life insurance policy for as long as the policy is in effect. Still, term life insurance is not intended to offer permanent coverage. If a policy is not renewed before the end of its term, its coverage will be canceled. It is possible to get it renewed annually if you have group coverage.

Total Existence

Whole life insurance is a kind of permanent coverage that accumulates a cash value over time and is intended to provide coverage for the insured person for their whole life. It is more costly than term insurance, but you have the potential to access the cash value over your life, and if you quit your employment, you can take the policy with you.

Available Riders

A life insurance policy may add additional components called riders, which can extend or raise the coverage. Some may be included for free, while others would cost an additional charge.

Accelerated Death Benefit: Terminal Illness

An expedited death benefit rider is available from Unum for those diagnosed with a terminal disease. If a doctor determines that you have a terminal disease, you are eligible to receive a part of the death benefit early, thanks to this provision. Although being supplied at no extra cost, this benefit is subject to administrative costs, which will lower the amount of the death benefit that is paid out to your beneficiaries.

Children's Term Rider

Adding a child term rider to your existing life insurance policy is one option to offer life insurance coverage for your current children and any children you may have in the future without having to buy a separate policy for each kid.

Waiver of Premium Rider

With a waiver of premium rider, if you become disabled, you won't have to make premium payments for as long as you continue incapacitating, often after an elimination period.

Assistance to Customers

Unum provides information on the many customer support channels available to its customers on its website. You may get in touch with the customer service department of your life insurance company by calling (866) 679-3054.

Understanding Bancassurance: An Overview of Its Mechanics and Value

May 08, 2024

Explore the evolution of bancassurance, its integration with technology, and strategic insights on navigating future financial trends.

Owner Financing

Oct 07, 2023

Other names for owner financing include "creative financing" and "seller financing." When owner financing is possible, it is common practice for this kind of financing to be described in the marketing materials for the property.

How Does an Exchange Rate Work?

Feb 23, 2024

The rate at which one currency can be exchanged for another is known as the exchange rate between two currencies. In other words, the exchange rate is the cost of one currency relative to another..

All You Need to Know About Mercury Credit Card

Jan 21, 2024

Let’s understand the 5 crucial factors you need to know about the Mercury Credit Card. Discuss the benefits, fees, rewards, and more.

How Much Does It Cost to Purchase Guaranteed Issue Life Insurance?

Feb 23, 2024

Individuals may purchase guaranteed issue life insurance under the false impression that they are ineligible for any other kind of insurance due to health issues. Read more.

Find Out How to File a Health Insurance Claim Form

Oct 03, 2023

Filling out a health insurance claim form can be intimidating. Proper claim form submission can ensure that you reimburse for health care expenses from your benefit plan.

Do You Know: What Are Emerging Markets?

Dec 23, 2023

The term "emerging markets" describes countries experiencing rapid economic growth while exhibiting some but not all of the features of a developed economy. Countries in the process of leaping from the "developing" to the "developed" stages of economic development are known as "emerging markets."

Pet Insurance Waiting Periods: What Every Pet Owner Should Know

Jan 21, 2024

Discover the ins and outs of pet insurance waiting periods. Learn how they impact coverage and make informed decisions for your furry friend's well-being.

Common Tax Deductions For The Self-Employed

Oct 13, 2023

Learn about common tax deductions for the self-employed to maximize your savings. Explore valuable insights on tax deductions for freelancers and entrepreneurs.

Best Features of Unum Life Insurance

Dec 07, 2023

As part of its benefits package for employees, Unum provides options for both term and whole life insurance.

Quota Share Treaty Demystified: Definition and Operational Insights

May 08, 2024

Explore the essentials of Quota Share Treaties in the insurance industry, their impact, benefits, and the future outlook in risk management and reinsurance.

The impact of the U.S. dollar on the international community

Nov 17, 2023

undefined